Proposed 2022 Budget Summary

Proposed Operating Budget

The 2022 proposed Operating Budget of $117.1 million results in a 2.5 per cent municipal property tax increase. Administration has incorporated cost efficiencies, corporate adjustments and service level adjustments reducing the initial tax requirement of 7.5 to 2.5 per cent. The 2.5 per cent includes our 1.5 per cent commitment to repairing, maintaining and/or replacing (RMR) funding, meaning that the general tax increase is 1 per cent.

This increase relates to the City’s commitment to being fiscally responsible by reducing spending to offset declining revenues and inflationary impacts. For an average house costing $450,000, this means an increase of $93 per year.

$93 (2.5%) tax increase based on the average cost ($450,000) of a St. Albert home.

The actual tax rate will not be finalized until May 2022 after the assessment roll is completed.

Tax Dollars at Work

To achieve financial sustainability, the budget focuses on corporate budget adjustments, deferring operating business cases and proposing reduction in service levels to re-prioritize resources. This allows the Citytocontinue to deliver programs and services most valued by residents and businesses while minimizing tax increases.

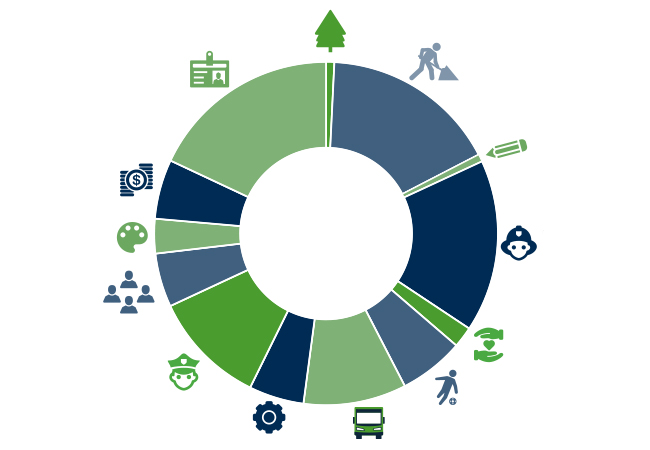

Proposed Distribution of Tax Dollars to Various Service Categories

For an average house valued at $450,000, the homeowner will see a $3,928 municipal property tax bill, an increase of $93 for 2022. The distribution of tax dollars to various service categories is illustrated below.

Excludes Provincial Education Levy, Homeland Housing Levy and utility charges.

![]() Environmental Sustainability: $28

Environmental Sustainability: $28

![]() Public Works: $640

Public Works: $640

![]() Planning & Economic Development: $65

Planning & Economic Development: $65

![]() Fire Services: $621

Fire Services: $621

![]() Community & Social Development Services: $77

Community & Social Development Services: $77

![]() Recreation & Parks: $208

Recreation & Parks: $208

![]() Transit: $398

Transit: $398

![]() Engineering Services: $201

Engineering Services: $201

![]() Police Services: $466

Police Services: $466

![]() Outside Agencies: $192

Outside Agencies: $192

![]() Culture Services: $115

Culture Services: $115

![]() Corporate Financing: $216

Corporate Financing: $216

![]() General Government: $701

General Government: $701

TOTAL = $3,928

Proposed Municipal Capital Budget

The Capital Budget provides for investments in infrastructure and capital assets such as constructing, buying or maintaining assets including roads, sidewalks, buildings, vehicles, equipment and land. This portion of the budget is important for critical maintenance of existing infrastructure and the future growth of our city.

For 2022, the municipal capital plan investment by asset category is illustrated below:

Civic Facilities: $10.6M

Historical/Cultural: $0.0M

Parks & Trails: $1.6M

Roads & Other Engineered Structures: $41.8M

Land & Land Improvements: $0.2M

Master Plan, Studies & Other: $2.0M

Mobile & Other Equipment: $7.5M

44 Projects

Total: $63.7M

Proposed Utility Budget

Utility Rate

The Utility Rate funds the operating and capital costs for water, waste water, stormwater, and solid waste programs that support St. Albert’s ability to provide clean, safe drinking water to its residents, as well as protect the natural environment through waste water treatment, stormwater and solid waste management.

$5.97 (4.5%) rate increase based on the typical monthly household utility bill ($139.01).

Proposed Distribution of Utility Bill

The proposed typical monthly bill for 2022 is $139.01, an increase of 4.5 per cent from the prior year. The allocations of monthly rates are as follows:

![]() Water: $41.35

Water: $41.35

![]() Solid Waste: $32.62

Solid Waste: $32.62

![]() Stormwater: $18.00

Stormwater: $18.00

![]() Waste Water: $47.04

Waste Water: $47.04

![]() Total: $139.01

Total: $139.01

Related Pages

Last edited: October 6, 2022